Texas 24 hour title loans provide quick cash using your vehicle as collateral but carry high-interest rates and risk of debt cycle. Lenders assess vehicle value, require valid license, clear title, and proof of income for approval within a day. Repayment options vary with terms differing between lenders. Responsible repayment through budget planning and timely payments avoids financial pitfalls while improving credit score. Consider lower-interest alternatives like San Antonio loans or building an emergency fund to mitigate debt.

In the state of Texas, accessing short-term funding through 24-hour title loans can be a quick solution for immediate financial needs. However, understanding the intricacies and potential risks is crucial before taking this path. This article guides you through the process, offering insights on evaluating repayment options and strategic approaches to avoid debt trapping associated with these loans. By the end, you’ll be equipped to make informed decisions regarding Texas 24-hour title loans.

- Understanding Texas 24 Hour Title Loans: Basics and Risks

- Evaluating Your Repayment Options for These Loans

- Strategies to Wisely Repay and Avoid Debt Trapping

Understanding Texas 24 Hour Title Loans: Basics and Risks

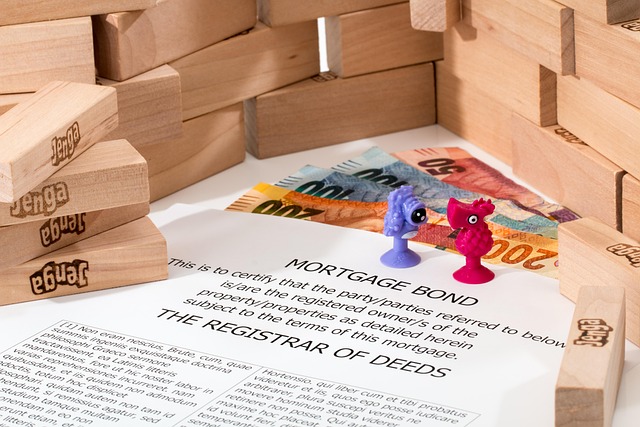

Texas 24 hour title loans are a type of short-term financing that offers quick cash to borrowers using their vehicle as collateral. These loans are designed for emergency financial needs, providing a fast solution for those in need of immediate funds. However, it’s essential to understand the basics and risks associated with such loans before making any decisions.

The process typically involves a lender assessing the value of your vehicle, then offering a loan amount based on that valuation. Loan requirements usually include having a valid driver’s license, a clear vehicle title, and proof of income. The approval process is often swift, hence the ’24-hour’ title, promising access to funds within a day. However, the risks lie in the high-interest rates and potential for a cycle of debt if not managed carefully. A cash advance can be tempting, but it’s crucial to weigh these factors before repaying Texas 24 hour title loans wisely.

Evaluating Your Repayment Options for These Loans

When considering Texas 24 hour title loans, it’s crucial to evaluate your repayment options carefully. These non-traditional loans, often secured against a vehicle’s title, come with distinct terms and conditions that can vary significantly between lenders. You might have the option to repay over a shorter period, like 15 or 30 days, which aligns with the loan’s purpose as a short-term solution. Alternatively, some lenders offer more flexible plans for Boat Title Loans, Semi Truck Loans, or Motorcycle Title Loans, allowing for longer repayment periods that can make the process more manageable.

Understanding these choices is essential to ensuring you select a repayment term that suits your financial capabilities. A hasty decision could lead to high-interest rates and fees, potentially trapping you in a cycle of debt. Take time to compare different lenders’ terms and conditions, consider your income, and assess how much you can comfortably afford each month. This strategic approach will help you wisely repay your Texas 24 hour title loan without causing undue financial strain.

Strategies to Wisely Repay and Avoid Debt Trapping

Repaying Texas 24 hour title loans wisely is a crucial step to avoid falling into a debt trap. One effective strategy is to create a detailed budget and stick to it. This involves tracking your income, fixed expenses, variable expenses, and loan payments. By understanding where your money goes each month, you can allocate funds to repay the loan without disrupting your daily life. Additionally, setting up automatic payments for your loan can help ensure timely repayments and avoid late fees.

Another important approach is to explore alternative sources of emergency funding, such as San Antonio loans or car title loans, which offer lower interest rates than traditional short-term loans. Building an emergency fund is also a proactive measure. By setting aside a small portion of your income each month, you can cover unexpected expenses without resorting to high-interest loans. Remember that timely repayment not only helps you avoid debt traps but also improves your credit score over time.

Texas 24 hour title loans can provide quick cash but come with significant risks. By understanding the basics, evaluating your repayment options, and employing strategies to avoid debt trapping, you can make informed decisions and wisely repay these loans. Remember, proactive management is key to keeping financial burdens at bay.