Texas 24-hour title loans provide swift financial aid secured by assets like vehicles, offering immediate cash access for emergencies. While ideal for those without traditional banking or poor credit, understanding terms and high interest rates is crucial. Compared to payday loans with high fees and short repayment terms, these loans have longer terms but require collateral. Secured options like Semi Truck Loans offer more flexible terms, providing safer alternatives for Texans needing short-term financial assistance.

In the state of Texas, borrowers often seek quick financial solutions, leading to a vibrant market for alternative lending options. This article delves into the world of Texas 24-hour title loans and compares them with traditional payday loans. Understanding these unique loan types is crucial for Texans navigating financial challenges. We explore how 24-hour title loans operate, their features, and potential risks, offering insights to help borrowers make informed decisions when considering these time-sensitive lending alternatives.

- Understanding Texas 24 Hour Title Loans

- How Payday Loans Operate in Texas

- Comparing Loan Options: Features and Risks

Understanding Texas 24 Hour Title Loans

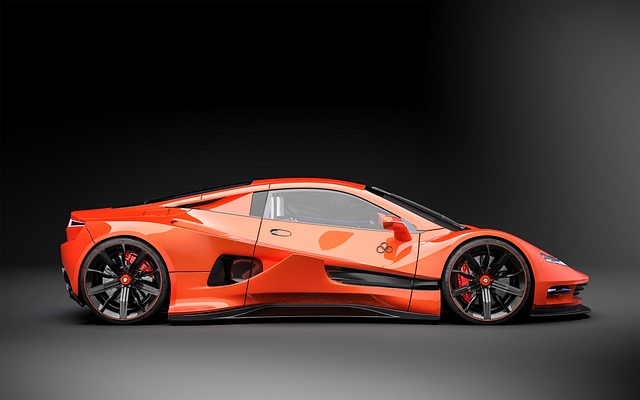

Texas 24 hour title loans offer a unique financial solution for individuals seeking quick emergency funding. This type of loan is secured by an asset, typically a vehicle like a car, truck, or even a boat or motorcycle title. The lender provides cash within hours, making it an attractive option for those in urgent need of money. The process involves signing over the title temporarily until the loan is repaid, ensuring the lender has collateral.

These loans are ideal for unexpected expenses, such as medical emergencies or car repairs. With no credit check typically required, they cater to people with limited access to traditional banking services or poor credit history. However, it’s crucial to understand the terms and interest rates, as these can vary significantly among lenders. Comparing different options, including boat title loans or motorcycle title loans within Texas’ 24-hour framework, is key to making an informed decision.

How Payday Loans Operate in Texas

In Texas, payday loans operate as short-term financial solutions designed to bridge the gap between paychecks. Borrowers typically provide lenders with a post-dated check for the amount they wish to borrow, along with a fee. The loan is then granted for a set period, usually until the borrower’s next payday. On that date, the check is cashed, and any additional fees are deducted. This quick and easy process appeals to many Texans who need immediate access to cash. However, it’s crucial to be aware of the potential risks associated with these loans due to their high-interest rates and short repayment terms.

Compared to Texas 24 hour title loans, which offer more extended repayment periods and often require a secured asset as collateral, payday loans are generally considered less favorable for borrowers. While they might provide fast relief, the short-term nature of these loans can trap individuals in a cycle of debt. Additionally, certain lenders may employ aggressive collection practices, further exacerbating the financial strain on borrowers. As an alternative to payday loans, secured loans like Semi Truck Loans could offer more flexible terms and payment plans tailored to the borrower’s needs, making them a potentially safer option for those seeking rapid financial assistance in Texas.

Comparing Loan Options: Features and Risks

When considering loan options, it’s crucial to understand the features and risks associated with each type. Texas 24 hour title loans stand out due to their rapid loan approval process, making them an attractive choice for those in urgent need of cash. This type of loan uses your vehicle’s title as collateral, which simplifies the application process and allows for quicker access to funds compared to traditional banking options. The loan terms are typically shorter, often ranging from 24 hours to a few weeks, emphasizing the need for careful planning to repay on time.

In contrast, payday loans also offer quick loan approval but often come with higher interest rates and shorter repayment periods. These loans do not require collateral, making them more accessible but potentially riskier as they can trap borrowers in a cycle of debt due to their high-interest structures. Unlike Texas 24 hour title loans, which are secured by an asset, payday loans rely on your future income, posing a risk if unexpected expenses arise or job situations change. Therefore, it’s essential to weigh these factors when deciding between the two loan types, focusing on what best aligns with your financial capabilities and goals.

When considering short-term financing options in Texas, understanding the nuances between different loan types is crucial. In this comparison, we’ve explored how Texas 24-hour title loans differ from traditional payday loans, shedding light on their unique features and potential risks. While both offer quick access to cash, Texas 24-hour title loans provide a more secured and flexible option with potentially lower interest rates. However, it’s essential to remember that all loan types come with considerations, and borrowers should carefully weigh the benefits and drawbacks before making a decision. Always assess your financial situation and explore alternative solutions if possible.