Texas 24 hour title loans provide emergency funding using your vehicle's title as collateral. Reputable lenders in San Antonio offer transparency, competitive rates, flexible terms, online applications, same-day funding via direct deposit, and personalized loan amounts. The best providers have quick approval times, diverse repayment methods, and customizable payoff plans for stress-free borrowing. Apply directly, assess your vehicle's value, compare lender terms, provide required documents, and await approval for swift financial aid. Some lenders also offer refinancing options.

In the competitive financial landscape of Texas, understanding your options is crucial when seeking quick cash through 24-hour title loans. This comprehensive guide aims to demystify these short-term lending solutions, focusing on key factors to consider before choosing a lender. We’ll review top lenders in Texas, providing an unbiased analysis to help you navigate this process efficiently. Learn how to apply step-by-step, ensuring an informed decision for your Texas 24-hour title loan needs.

- Understanding Texas 24 Hour Title Loans: Key Factors

- Top Lenders in Texas: A Comprehensive Review

- Applying for 24-Hour Loans: Step-by-Step Guide

Understanding Texas 24 Hour Title Loans: Key Factors

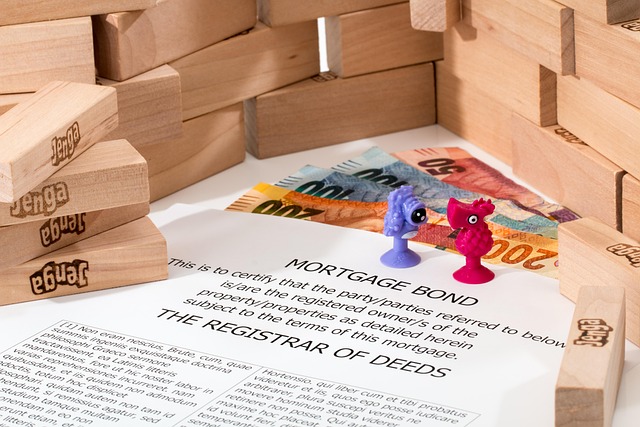

Texas 24 hour title loans are a quick solution for individuals seeking immediate financial aid. These loans, as the name suggests, provide access to funds within a day, making them ideal for unforeseen expenses or emergencies. The process involves using your vehicle’s title as collateral, ensuring a swift approval and funding mechanism. However, it’s crucial to understand the key factors that distinguish reputable lenders from less reliable ones in this fast-paced market.

When considering San Antonio loans or any car title loan options, transparency, competitive rates, and flexible terms are essential. Lenders should offer clear terms and conditions, outlining interest rates, repayment schedules, and potential fees. A direct deposit of funds is often a preferred method, ensuring immediate access to the borrowed amount. Additionally, borrowers should look for lenders who provide a range of loan amounts, catering to different financial needs, while also offering the convenience of online applications and easy-to-follow processes, especially when compared to traditional banking methods.

Top Lenders in Texas: A Comprehensive Review

When it comes to Texas 24 hour title loans, the state offers a plethora of lending options, making the choice daunting. However, several lenders stand out for their reliability and customer-centric approach. Top lenders in Texas often advertise quick loan approval processes, flexible loan terms, and various repayment options. These institutions understand the urgency behind short-term financing needs and cater to borrowers with diverse financial backgrounds.

A comprehensive review of these lenders reveals a focus on transparency, competitive interest rates, and easy access to funds. Many reputable Texas 24 hour title loan providers allow borrowers to customize their loan payoff plans based on their comfort levels and financial capabilities. This level of flexibility ensures that the loan is not just accessible but also manageable for individuals seeking quick financial relief.

Applying for 24-Hour Loans: Step-by-Step Guide

Applying for a Texas 24-hour title loan is a straightforward process designed to provide quick access to emergency funds. Here’s a step-by-step guide to help you navigate this option when immediate financial assistance is needed. Firstly, determine your vehicle’s value to ensure it qualifies as collateral for a secured loan. Next, research lenders offering 24-hour title loans in Texas, comparing their terms, interest rates, and requirements to find the best fit. Once you’ve selected a lender, prepare necessary documents such as your vehicle’s registration, proof of income, and valid ID.

Fill out the application form provided by the lender, ensuring all information is accurate and complete. After submission, a representative will review your application and may require additional verification. If approved, expect a quick turnaround time, often within the same day, as the lender processes the loan and prepares the funds for disbursement. For those looking to consolidate debt or refinance an existing loan, some lenders offer loan refinancing options, allowing you to potentially secure better terms on your existing 24-hour title loan.

When it comes to choosing the best lender for Texas 24 hour title loans, understanding your options and what factors matter most is key. By reviewing top lenders and their services, you can make an informed decision that fits your needs. Remember, while these loans can provide quick access to cash, it’s crucial to navigate the process responsibly and understand the terms before securing a loan. With the right lender, Texas 24 hour title loans can offer a reliable solution for unexpected expenses.