Texas 24 hour title loans boom due to strong economy, offering quick cash secured by vehicle titles. Borrowers should compare lenders based on interest rates, fees, terms, prepayment penalties and reputation. Despite risks of high-interest and collateralization, these loans provide same-day funding and retention of vehicles, appealing for urgent needs like Semi Truck Loans.

Texas residents often turn to 24-hour title loans for quick cash. This competitive market offers various providers, each with unique terms. Exploring Texas’s rapid title loan landscape is crucial before securing a loan. This article breaks down key factors to compare 24-hour providers, helping you navigate risks and benefits of short-term loans. By understanding the market, you can make an informed decision regarding your financial needs.

- Exploring Texas's Rapid Title Loan Market

- Key Factors to Compare 24-Hour Providers

- Navigating Risks and Benefits of Short-Term Loans

Exploring Texas's Rapid Title Loan Market

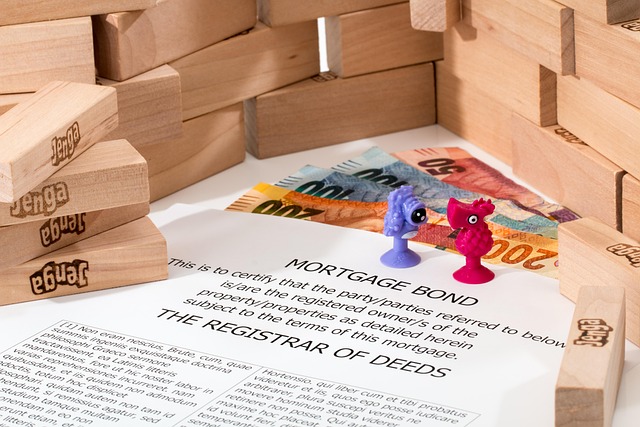

Texas’s market for 24-hour title loans has seen a surge in activity, driven by the state’s robust economy and a growing demand for quick financial solutions. This dynamic sector offers residents access to short-term funding secured against their vehicle’s title, providing an attractive option for those needing cash fast. With various providers vying for customers, understanding the landscape is essential for making informed decisions.

The appeal of Texas 24-hour title loans lies in their flexibility and accessibility. These loans cater to a wide range of borrowers, including those with less-than-perfect credit histories. Repayment options can be tailored to individual needs, offering either lump-sum payments or more manageable monthly installments. Moreover, the market includes specialized financing for semi-truck owners seeking semi truck loans, ensuring that specific financial needs are addressed. Despite varying interest rates, responsible borrowing and transparent terms from reputable lenders can help borrowers navigate this alternative lending option effectively.

Key Factors to Compare 24-Hour Providers

When comparing Texas 24 hour title loan providers, several key factors come into play to ensure a borrower makes an informed decision. Firstly, consider the interest rates and fees charged by each provider. These can vary significantly, so it’s crucial to understand the total cost of borrowing. Secondly, look at the lender’s terms and conditions regarding repayment schedules and any prepayment penalties. Flexibility in repayments can be beneficial for borrowers’ financial plans.

Additionally, evaluating the reputation and customer reviews of the providers is essential. Check if they offer transparent processes, secure transactions, and reliable support. Some providers may specialize in specific loan types like car title loans or title pawn, while others cater to debt consolidation needs. Understanding these specializations can help borrowers find the most suitable provider aligned with their requirements.

Navigating Risks and Benefits of Short-Term Loans

Navigating the world of Texas 24 hour title loans can be a complex task. While these short-term financing options offer quick approval and access to cash, they also come with inherent risks. The primary concern is the high-interest rates associated with such loans, which can quickly compound and lead to a cycle of debt if not managed properly. Additionally, borrowers often have to put up their vehicles as collateral, posing the risk of losing them if they fail to repay on time.

However, for those in urgent need of funds and who own a valuable vehicle, Texas 24 hour title loans can be a viable short-term solution. The process is designed to be swift, with many providers offering same-day funding. Furthermore, keeping your vehicle can be a significant advantage compared to traditional loan options, especially when considering alternatives like Semi Truck Loans. This flexibility ensures that you maintain control over your assets while accessing the financial support you need.

When considering Texas 24 hour title loans, it’s crucial to weigh both the immediate relief and potential risks. By understanding key factors like interest rates, repayment terms, and regulatory compliance, borrowers can make informed decisions in a competitive market. While these short-term loans offer rapid access to cash, careful navigation is essential to avoid pitfalls and ensure a positive experience.